Addressing Mental Health for China's 180 Million Seniors: A Trillion-dollar Market

According to data from the National Bureau of Statistics in 2021, China's population aged 60 and above is around 267 million, accounting for about 18% of the total population. Among them, a study by the Chinese Academy of Sciences indicated that the psychological well-being rate among elderly individuals in urban areas is 30%, while in rural areas, it's only 27%.

In other words, the psychological well-being rate for Chinese individuals over 60 years old is less than 30%.

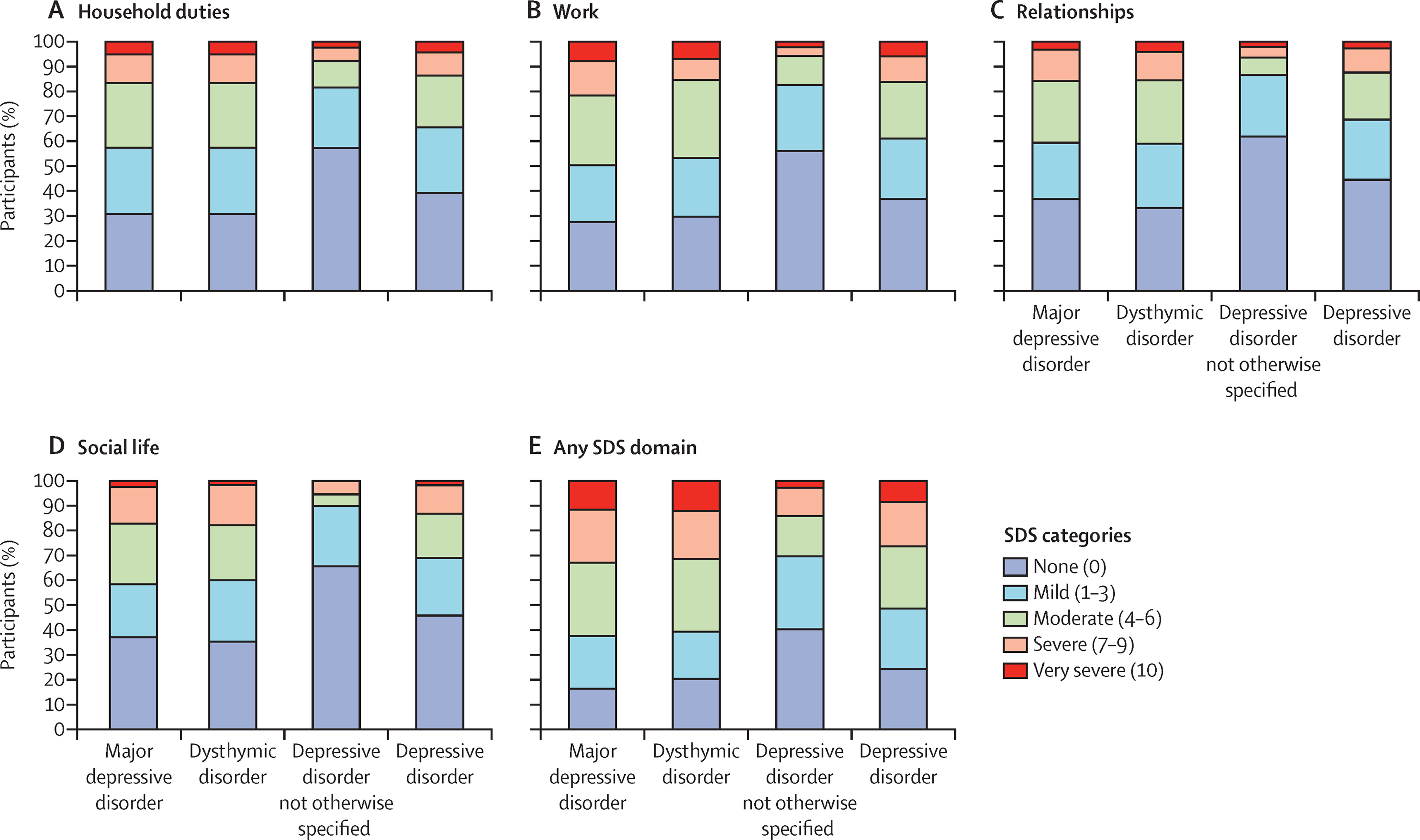

Evidence shows that as people age, their vulnerability encompasses not only their physical health but also their mental well-being. This vulnerability might be greater than expected. For instance, around 16% of individuals aged 60 and above in China suffer from depression, while the prevalence of depression among adults in the country is only 3.4%.

The psychological well-being of China's elderly has long been relegated to a "hidden corner" with limited introspection. Phrases like "I'm getting forgetful in my old age," "I've been having trouble sleeping at night lately," and "I don't know why I have to live so long" have been taken as casual expressions of aging rather than indications of psychological issues.

Fortunately, this situation is beginning to change.

First, in the policy landscape, China elevated "actively addressing aging" to a national strategy in 2021, and accompanying policies have gradually been implemented. These policies encourage caring for the psychological conditions of the elderly, advocate for improved service levels, promote the establishment of grassroots mental health networks, and include psychological well-being as a criterion for assessing healthy aging.The market context is equally important. After the pandemic, the mental health sector began to gain traction. According to previous data from Artery Network, starting from 2020 China's mental health sector completed a total of 84 financing deals, with leading companies progressing to B and C rounds. The business models for all-age psychological therapy are becoming clearer, new therapies and technologies are entering the field.

As policies take shape, societal awareness grows, and demand increases, companies in this sector are on the verge of an era of rapid expansion.

Pain Points: Addressing More than Just the Surface

"We've noticed a significant increase in older people seeking treatment," says Xu Feng, COO of Haohappy Health Group, a leading platform in China's psychological health sector. According to their statistics, more than 10% of patients above 65 years old suffer from insomnia, anxiety, and depression.

Guo Tingting, the Founder and CEO of PauseLab, shares a similar sentiment. PauseLab is a digital mental intervention brand often referred to as the "mental fitness center," akin to a psychological version of the fitness app Keep. The platform offers users online intervention plans to enhance emotional regulation. The platform has around 76,000 paying users, with approximately 7% being above 50 years old, and the oldest user being 81 years old. The user data among middle-aged and elderly groups surprised Guo Tingting and her team since PauseLab's marketing efforts have never specifically targeted the elderly.

Indeed, with the rapid growth of middle-aged and elderly internet users (over 50 years old), the digital divide is narrowing. In the field of mental health, digital products and services do not present significant barriers to use among older adults. On the contrary, "their compliance might even be better." Based on PauseLab's experience, "middle-aged and elderly users practice for an average of 17 more days than younger users."

Digital technology effectively enhances the accessibility of psychological services, eliminates the "shame of illness," and covers populations with limited mobility, making it a consensus within the industry that these advantages extend to older adults. However, the real challenge lies in the coexistence of mental health issues and physiological illnesses in the elderly, complicating diagnosis and treatment.

"For instance, if an elderly individual visits a psychologist complaining of frequent nervousness and sudden palpitations, how do we rule out the possibility of coronary heart disease?" explains Lin Zhaoyu, founder of Zhaoyang Health. Lin, a psychiatrist with 20 years of clinical experience, leads Zhaoyang Health, a prominent digital psychiatric diagnostic and treatment platform in China.

Beyond diagnosable illnesses, the challenge also encompasses discomfort brought about by physical decline in the elderly. With regard to this demographic, compared to offering solely psychological health services, creating a comprehensive service chain for elderly psychological well-being warrants more consideration.

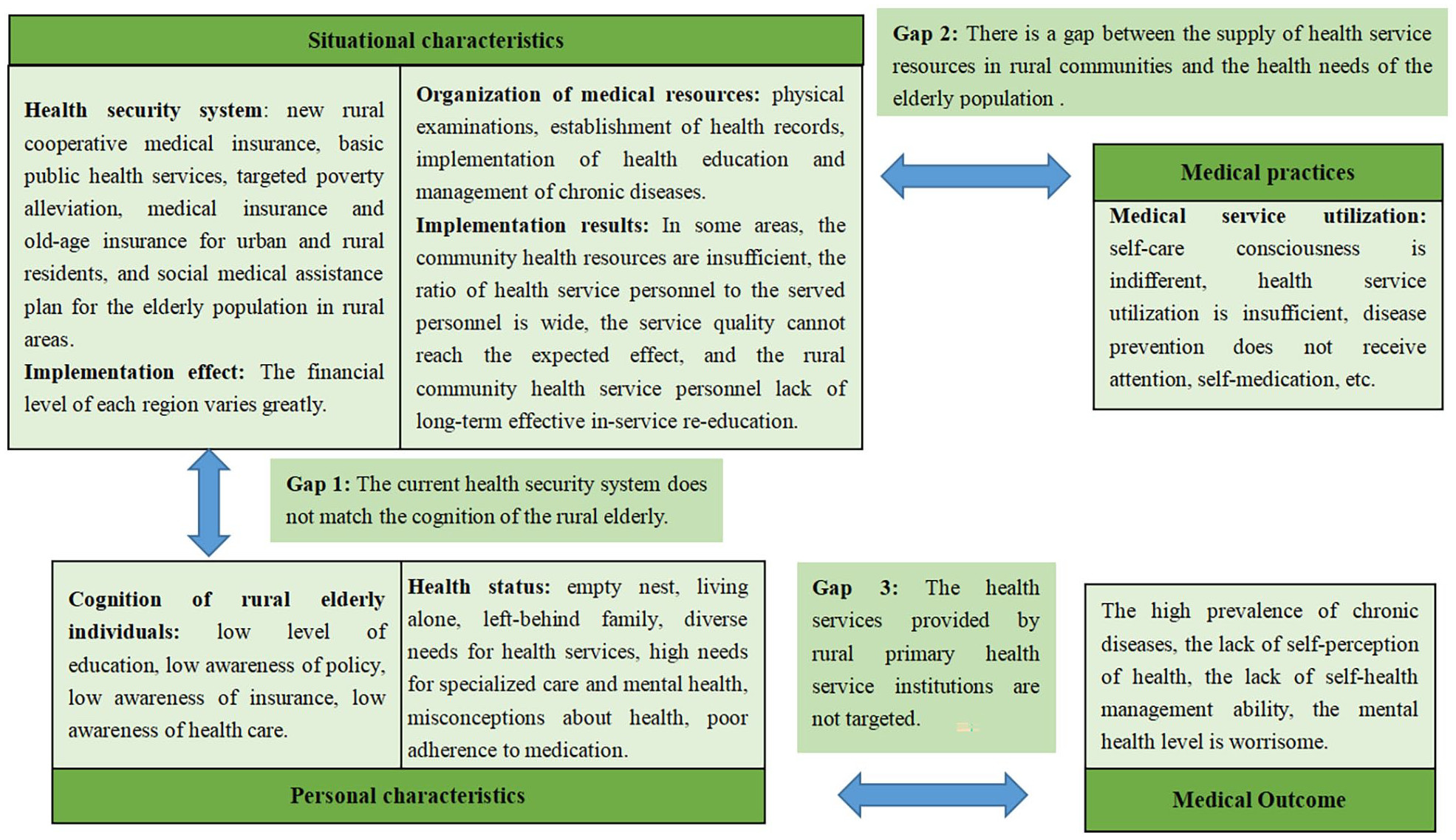

The concept of a psychological health service chain for the elderly includes both medical and non-medical aspects.

Lin Zhaoyu proposes viewing the demand for elderly psychological health services as a pyramid. At the top are medical-level services, which include physiological-related services. At the base are non-medical services, which extend beyond psychological counseling to include services like senior universities and community activities. When providing services, different levels of elderly individuals should receive corresponding services. Professional mental health practitioners are responsible for assessing, guiding, and managing these diverse needs.

Zhaoyang Health's practice aligns with this approach. The platform takes on the role of integrating the service chain, offering diagnostic and health management plans, and "segmenting" patient needs. Currently, Zhaoyang Health has collaborated with over ten senior service organizations besides integrating medical-level services, fostering the establishment of an ecosystem for elderly psychological health services.

Elderly Mental Health: Bridging the Gap in China's Silver Market

From this perspective, the issue of elderly mental health treatment is, in fact, a part of the overall elderly care ecosystem.

In an interview, Jiang Xiaodong, Managing Partner at Changling Capital, who has long been focused on the senior care and broader health sectors, shared a similar viewpoint, stating that the most significant challenge in the elderly market is insufficient supply.

When it comes to the field of mental health, Jiang Xiaodong pays special attention to cognitive changes in the elderly.

Jiang mentioned that what we see as insomnia, anxiety, and depression are essentially "manifestations" of cognitive issues. As cognitive abilities decline and change, the way elderly individuals interact with society and others might undergo significant transformations.

"By focusing on cognitive function, expanding the 'toolbox' of psychological therapy for early intervention and management, we can better address the issues in the elderly market." In this context, companies working on cutting-edge technologies like digital therapy and brain-computer interfaces might provide more solutions.

Additionally, payment remains an ever-present concern in the mental health industry. Xu Feng mentioned that the elderly market relies more on medical insurance.

However, strictly speaking, only Guangdong and Jiangsu provinces have included psychological therapy in their medical insurance coverage. Patients need to seek treatment at designated hospitals and the reimbursement range is between 160 to 200 yuan per session.

Moreover, there are limitations. In Jiangsu, for instance: 1) qualified professionals must provide treatment, 2) treatment must take place in a separate space, and 3) the treatment session should last for at least an hour.

Objectively speaking, most of the current psychological health services are excluded from medical insurance coverage. The situation is similar in the commercial insurance sector for psychological health. This situation is linked to the nascent state of the domestic psychological health industry: a lack of standardized delivery solutions and adequate support from risk data. With increasing practice in psychological services and gradual improvement of the service chain, Xu Feng is optimistic about innovative medical insurance coverage for psychological health.

At present, including psychological therapy in medical insurance not only alleviates the economic burden on patients but also serves as a means of "disease education" — making more people aware that mental health issues are no different from physical illnesses.

Despite practitioners mentioning that "the number of elderly individuals seeking help voluntarily is increasing," there remains a substantial gap between the incidence, awareness, and treatment rates of mental illnesses. Currently, rather than competing for the "existing demand," it might be more advantageous to work together to expand the "incremental demand."

Opportunity: The Toolbox Determines the Outcome

In the era of digitization, every business deserves a thorough reevaluation.

This statement holds especially true for the medical field, and even more so for the realm of psychology. For the elderly market, the principles of psychological therapy haven't changed, but under the influence of digital technology, a growing number of "approaches" are emerging.

Jiang Xiaodong refers to these "new approaches" as tools within the toolbox of psychological therapy. Faced with a variety of tools on the market, he considers proven effectiveness and scalability as criteria for selecting projects.

A Batch of Robots Getting Ready to "Work"

Xu Feng believes that artificial intelligence robots hold significant value in providing mental health services for the elderly.

Take "Xin Xin" from Haohappy Health as an example. It is an AI robot that focuses on "companionship." It can provide users with 24-hour psychological companionship and emotional guidance through dialogue. During testing, although the product is not exclusively designed for the elderly, it has garnered over ten thousand experiences, with over a thousand users paying for the service.

"In this aspect, data is key. Different data can be used to train different AI products. For instance, by studying the chat records of medical professionals and patients discussing depression, we can create a conversational robot skilled in dealing with depression." As the largest internet-based mental health service platform in China, Haohappy Health has accumulated a wealth of relevant data. Xu Feng stated that the platform has formed a team dedicated to the development of specialized models for mental health.

Elderly psychological issues are often the result of complex factors. Research indicates that companionship serves as a "remedy" for preventing and alleviating cognitive disorders or psychological diseases like depression among the elderly. When expanding our view to encompass broader elderly care, numerous interdisciplinary ventures are emerging, providing intelligent senior-oriented products represented by companion robots. Companies like Baidu, Midea, and UBTech have joined this endeavor.

These robots mainly focus on home elderly care scenarios, either emphasizing emotional conversations or medical assistance. Although it is currently difficult to definitively determine the extent to which such "companionship" can alleviate psychological issues among the elderly, these robots are increasingly "seeing" the richer inner world of China's elderly population.

A "Cognitive Function Grand Campaign"

Jiang Xiaodong emphasized changes in cognitive function among the elderly when discussing elderly mental health.

In fact, elderly cognitive disorders represented by Alzheimer's disease are considered a significant challenge in aging societies. As these conditions are irreversible and incurable, prevention and intervention to reduce or delay their progression are the mainstream treatment approaches.

Jiang Xiaodong is optimistic about the application of digital therapy and brain-computer science in this field.

In this context, BostenTech is Changling Capital's investment focus in the field of elderly cognitive function. According to Artery Network's statistics, there were a total of six relevant investments in this area in the past year, all of which were below Series B rounds.

Jiang Xiaodong believes that most companies at this stage have demonstrated the effectiveness of their products through research and are now facing the challenge of scaling up.

Fortunately, some star projects have emerged in this field, which can serve as examples for newcomers.

In August, the startup "Liu Liu Brain" (Zhejiang Brain Aurora Medical Technology Co., Ltd.), founded by a neuroscience Ph.D., stood at the door of the capital market, on the verge of becoming China's first publicly traded digital therapy company.

Reportedly, "Liu Liu Brain" has developed a comprehensive pipeline of digital therapy products, with the system designed for various cognitive disorders, covering assessments and interventions for four main types of cognitive disorders: those caused by vascular diseases, neurodegenerative diseases, mental illnesses, and developmental disorders in children.

In addition to the main system, "Liu Liu Brain" has developed three other digital therapy products for cognitive disorders: Basic Cognitive Ability Testing Software ("BCAT"), Cognitive Ability Screening and Assessment Software ("SAS"), and Cognitive Disorder Treatment Software ("ADHD Software"), which received the EU CE Mark in 2022 and regulatory approval.

According to their prospectus, in 2021, 2022, and the first quarter of 2023, "Liu Liu Brain" generated revenues of 2.299 million yuan, 11.291 million yuan, and 10.564 million yuan, respectively. This indicates that "Liu Liu Brain" has experienced rapid revenue growth and a positive trend towards marketization.

In addition to utilizing technological approaches, some companies are focusing on the family care model.

Established in 2015, Kai Xin Medical is a healthcare service institution that manages the full course of psychological and mental illnesses. They are committed to providing comprehensive medical management services for children and adolescents' psychological therapy and the complete medical journey of elderly dementia patients.

Among them, Jing'an Hospital in Shenyang has integrated digital technology to create the "HSH (Hospital-Community-Home)" care model. The HSH care model is based on the concept of "screening-diagnosis-hospitalization-home" for the complete medical and nursing management of mental illnesses. It offers continuous care services to elderly patients.

This model provides seamless integration between hospital, community, and home, extending the hospital nursing model and methods to the community and home to avoid blind spots in care. It offers scientific guidance on medication for patients, providing community support and home care after discharge.

The Collision of Scientific Core and Consumer Internet

Paused Laboratory, founded by Guo Tingting, was one of the first companies to achieve large-scale revenue in the consumer-grade digital health market.

Paused Laboratory targets the market gap between "self-regulation" and "one-on-one diagnostic intervention," serving both the general population and end-users experiencing a wide spectrum of emotional distress outside the hospital.

To achieve this, Paused Laboratory's mental health services follow a "scientific core + consumer shell" model. This means they need both a significantly effective digital professional psychological intervention model and a scalable, popular, and disseminable gene.

Analyzing Paused Laboratory, we can clearly see the "Internet productization of psychological science."

First, all platform product designs are evidence-based. With this as the "starting point," how can the "utility" of psychological science be maximized?

Firstly, by "simplifying thinking." Based on evidence, a "universal" mass psychological intervention is found and a comprehensive skill training system across diagnoses is designed, standardizing the product. Moreover, the process of user involvement in psychological interventions is made as "simple" as possible. Guo Tingting maintains a cautious stance on the use of "non-essential" new technologies and devices, as they could increase user barriers.

Secondly, "user thinking." A typical example is the design of the "course" dynamic system. "Consistency" is a key factor affecting the results of user psychological improvement. To enhance users' motivation to practice, Paused Laboratory designed the "task mechanism" while fully "making excuses for users."

(1) Fastest Launch Principle: Daily practice tasks are light, ensuring the lowest difficulty for initiation, and then gradually increasing.

(2) Dual-Driven by Improvement and Reward: In addition to periodic improvement assessments, during the user's practice, the platform manages the user's "milestones," provides feedback on their milestone achievements, and sets up scholarship rewards after users complete all courses.

(3) "Procrastination" Blessing: It aligns with modern lifestyle habits; the task's end and the new day's update time is 5 AM.

(4) User "Slacking" Mechanism: Each practice plan is 25 days, but actual tasks are only set for 22 days.

This user-centric approach translates into a significant advantage in data. For instance, a foreign leading digital therapy, Happify, had only 9.76% of users who completed practice sessions within a single course. In comparison, Paused Laboratory's 25-day intervention plan had a completion rate as high as 63% for new participants and 72% for returning users.

Additionally, the product is iterated based on user feedback. In operation, the team observed that elderly users were more inclined to use sleep products. Guo Tingting stated, "We've made some age-appropriate updates to better align with the lives of the elderly in different scenarios."

"The middle-aged and elderly market could become the next focus of platform development." Guo Tingting mentioned that they will attempt to optimize products and market promotion for the elderly population in the future.

More Innovators

Apart from this, insurance companies have begun to take steps, covering elderly mental health services within "senior community activities."

In December 2021, Dajia Insurance Group launched the senior brand "Our Home," offering a business development model of "insurance coverage + elderly services" to provide comprehensive, full-lifecycle elderly services for families.

According to information, aligning with the needs of the elderly population, Our Home has established eight service lines: medical, rehabilitation, nursing, living, diet, recreation, travel, and healing. Among them, the recreation services focus on the psychological health of the elderly, including their sense of social participation, belonging, and being needed.

Here, music therapy experiences are the most popular activities among the elderly.

Before therapy, music therapists conduct multiple interviews, observing and recording attention span, physiological, emotional, social, cognitive performance, and listening, speaking, reading, and singing abilities of the elderly. Based on comprehensive evaluations, they design personalized intervention plans.

The Our Home recreation service team conducts various music activities for different groups (self-care elders, semi-self-care elders, elders with cognitive disorders), such as interactive instrumental playing for beginners, using music therapy to regulate sleep disorders, and organizing targeted music therapy interventions.

According to the introduction, most members of the Our Home recreation team have professional backgrounds in psychology, psychiatry, and sociology. Currently, the team has developed dance therapy, music therapy, pet therapy, and other treatment methods.

Conclusions

The root cause of the "unhappiness" among 180 million elderly individuals is both a societal and commercial problem, harboring a market worth hundreds of billions of dollars waiting to be explored.

Currently, actively addressing aging is a national strategy, and "adequate eldercare" is a significant topic and trend. The highly educated population, younger groups, capital, and technology are all entering related industries. According to Tianyancha's Professional Edition data, there are currently over 212,000 companies in China with names or scopes related to "elderly, aging, elderly care."

The intersection of psychological science and elderly care is a field that has only gained attention in China in the last two years. It is currently in the stage of improving service supply and requires guided development. However, we see that the current coverage of psychological service companies in this field and the involvement of more "cross-border" participants are making this market increasingly imaginative.

Of course, there are still many challenges. User awareness is low, the service chain is loose, service efficiency and accessibility, medical insurance support are just beginning, companies are in the early stages of development, and new models require market validation...

Fortunately, the ship has set sail. Answers will gradually become clearer through practice and discussion.

When talking about elderly mental health, many express that they are "waiting for the right time to break out."

Related Insights.