Published on 11/07/2016 | Market Sizing

By now CIOs are aware of Internet of Things (also referred to as M2M – machine-to-machine communications). For a while it remained a fad but now it is a very serious business consideration to augment customer experience. Also, most of us now have a hazy idea of how it works. Most us skeptics, including a bit of me, have had a firm belief that IoT or M2M is best used in industrial or manufacturing environments. To a large extent this perception isn’t baseless. Early adoption trends shown by the manufacturing sector, especially automotive, makes us all rally behind this belief.

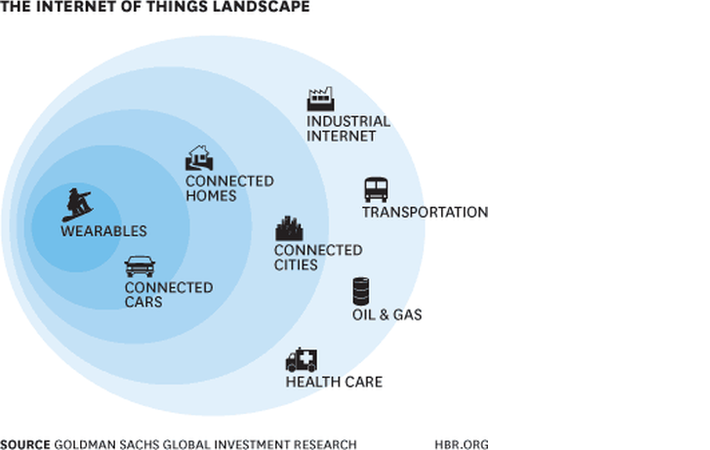

According to Goldman Sachs the sectors which have benefited the most by IoT/M2M are wearables, smart homes & cities, industrial internet, transportation, connected cars, healthcare, agriculture and perhaps oil and gas explorations.

But isn’t it surprising to not find the banking and other financial institutions in the picture above? Indeed! But it is also true that when it comes to technology adoption, the financial sector companies (banks specifically) are late starters compared to other industries. While there’s logic to it, but the key reason is that most BFSI companies have grown organically. Any sort of inorganic expansion calls for ridiculous amount of integration of backend systems and that causes unpredictable, untimely, uncalled for complexity. Having said that, status quo is also not an answer. Of late, two key things have forced banks to break free from the old, rustic ideas and stay abreast with innovation that has raged other industries. The first reason is compliance norms prescribed by various regulators that force BFSI cos to be responsive and therefore deploy cutting edge tech. The second is to stay in the hunt; stay relevant. There’s competition coming now from most unusual quarters. Non-banking companies are giving a tough time to banks. Take for example, mobile/digital wallets – the most fiercely competitive markets of today. It emerged from almost nowhere and the banks were caught unawares while it swept the market. Now since the banks are cautious and want to stay with what customers think and wants, they are keenly looking at stuff like Internet of Things (IoT).

But Verizon feels that banking industry’s biggest challenge will be in catching up with early adopters that moved forward with IoT applications. Exactly a year ago, American Banker and SourceMedia Research conducted a study “Internet of Things in Banking” for Verizon and found out that a mere 13% of banks were implementing an M2M solution, which means they’re a whole generation behind from certain key sectors like automotive, smart homes, health etc. which have already mainstreamed IoT.

(access full image here)

This is an guess where’s the IoT being used the most in case of banks. According to the reports, 33% of the banks were using it for managed ATMs or ATM monitoring. In future banks may think of using IoT for capturing social media and mobile interactions of its customers.

At least banks have realized that IoT has the same transformative potential as Internet around two decades ago. Today it may not be true but soon (rather very soon), with the help of the analysis of data from IoT will enable banks to provide very precise predictions of what customers will like, what they will need, and what they will do.

In May 2015 Economic Times published a news article that demonstrates some of what I have stated above. Chennai-based Financial Software & Systems and Gurgaon-based iYogi have actually deployed IoT and software-automated processes to help banks cut costs across the board by saving power, curbing pilferage, managing incidents such as stuck debit cards, and even remotely controlling the ATM to shut it whenever the security alarm goes off. One of the best uses of IoT in ATM management could be remote ATM monitoring. Using sensors, a bank can save a lot on sending technicians to fix glitches at ATMs.

FSS claims to have deployed software to detect and inform about common incidents such as card reader malfuctions, stuck receipts, low cash and high degree of power wastage that commonly occur at an ATM.

Falk Rieker, Global Head of Banking Business Unit, SAP wrote an interesting article in May 2015. He says that banks are using the IoT technology to provide a more convenient and rewarding experience for their credit and debit card customers. According to Falk banks have started partnering with companies like Edo, (a company providing personalized offers and make them available through credit or debit cards and mobile devices) to reward customers for their purchases in real-time. This type of IoT technology uses geographical data to identify offers and deals from nearby merchants that become active as soon as the customer swipes their debit or credit card at said merchant. “Pairing IoT with analytics is also enabling banks to provide location-based, real-time discounts,” says Falk.

But it is all beginning to happen. How soon can the banks and other FSIs embrace IoT is a question that only the CIOs can answer. Probably they are too inhibited and cautious by the complexities and security concerns arising from IoT implementation. In the Verizon study (refer infographic), 92 percent banks surveyed said they are dealing with complexity in deploying IoT and 35 percent said they have security risks. Most Internet of Things devices aren’t really architected for security. They were more based on convenience.

Like the initial days of internet, which helped many bad actors to start committing cybercrimes, the IoT also potentially exposes many new fronts and introduces lots of risk to the banks and other FSIs.

A study by Booz Allen says, “With the internet of things, cyber risk now stretches across a third dimension. Employees may come to work with a compromised wearable device, or pull their hacked connected vehicle into the company parking lot. This creates a new type of cyber risk for organizations—with significantly increased complexity and exposure.”

The study points to a rising trend of “proactive defense,” which shifts away from simple response. Even the banks have to become proactive in offering cyber defense.

But I suspect if banks and other FSIs will stop themselves short of adopting IoT just because there is an element of threat. If it hasn’t stopped any other industry, it won’t prohibit banks too.

However, it is yet to be seen how banks will turn it to their advantage as auto and health sectors have.

Are Indian Bank CIOs deploying IoT? I am listening.

This article was originally posted on LinkedIn.