Published on 08/07/2017 | Market Sizing

Key Highlights

On Friday, June 16, Amazon announced it was acquiring Whole Foods Market for $13.7 billion, the largest acquisition in the online retailer's history.

Just a few hours later, Walmart announced the completion of its $310 million acquisition of the men's apparel direct-to-consumer retailer Bonobos.

Whole Foods' prime real estate allows Amazon to finally get into last-mile delivery, something the online retailer has historically struggled to do. Whole Foods has a 456-store footprint in the US, Canada, and the UK, mostly in upmarket, urban areas.

The significant implications of the Amazon/Whole Foods deal for the grocery and retail spaces explain why many retailers' stocks took a big hit after the news (down 5-10%).

Walmart is pushing a strategy to buy vertically integrated companies because of higher gross profit margins. Whole Foods has some private label, but it accounts for only around 15% of revenues.

Groceries is an important category - a recent report by the Food Marketing Institute (FMI) found that US grocery sales could grow five-fold over the course of the next decade, with spending estimated at more than $100 billion by 2025.

The FMI survey highlighted how 69% of shoppers valued the store's reputation when choosing which store to buy groceries at, making Whole Foods' brand an important asset for Amazon to leverage.

Walmart is the nation's largest seller of groceries, selling over $170 billion last year, and the category is a key driver of store traffic and customer loyalty. Walmart has invested and tested in click-and-collect programs, stand-alone grocery pick-up sites, and even testing of an automated kiosk for 24-hour pick-up.

Many voice concerns that not only do Walmart and Bonobos customers not overlap, but that Walmart's acquisition may in fact push several away.

In just the space of a few days, the retail world was shaken by two big acquisition announcements from the industry’s goliaths: Walmart and Amazon. The latter grabbed the lion’s share of the headlines, announcing its acquisition of Whole Foods Market last Friday for a whopping $13.7 billion, making it the largest acquisition in the company’s history (dwarfing their $1.2 billion acquisition of Zappos in 2009).

As the markets were still coming to terms with the news, Walmart quickly followed up with its announcement of its acquisition of Bonobos, the direct-to-consumer (DTC) menswear retailer, for $310 million. As Fast Company highlighted, “The move threw into relief exactly how fiercely [Amazon and Walmart] are competing for the American consumer by working to seamlessly integrate online and offline shopping experiences.”

As the dust settles, it does seem clear that Amazon’s move will be far more significant, influential, and disruptive than Walmart’s. With the acquisition of Whole Foods, Amazon is possibly embarking on a radical disruption of brick & mortar retailing in the US, leaving Walmart to play defense.

Amazon Buying Whole Foods Is a Big Deal

Consensus is overwhelmingly that Amazon’s acquisition of Whole Foods is a big deal. “Amazon buying Whole Foods is incredibly interesting, highly strategic, and definitely not standard” said Toptal Finance Expert Josh Chapman. Recalling the video introducing Amazon Go (below) which surfaced at the end of last year, Chapman believes “[it was] Amazon’s vision all along and I believe it is front and center in their vision for Whole Foods. Amazon Go will now become the tech that will engulf every Whole Foods store across the country. I’ll be as bold as to say that Amazon buying Whole Foods is the start of an incredible wave of innovation across the grocery/shopping landscape.”

The belief in Amazon’s capacity to revolutionize the in-store grocery experience (on the tails of Amazon’s other recent foray into brick-and-mortar bookstores), is echoed by several others. Toptal Finance Expert Sebastian Fainbraun, who is an investor and board member of Dolcezza Gelato, a distributor to Whole Foods in the Mid-Atlantic, envisions a radically different in-store experience: “Imagine going to Whole Foods to get fruits, meats, and vegetables, plus other cool impulse buys, but also at your checkout having a bag of your monthly automated items waiting for you. Amazon has the analytics as well as the logistics. It’s going to revolutionize shopping. For Whole Foods, they have prime real estate and eventually can use that space for things other than food. If I were a retail landlord, I would be very worried unless I have those types of properties. Imagine the same model but at a mall with clothing and accessories.”

Putting aside the potential for change in the retail experience, both see implications that go far beyond. Chapman, a former investment banker at Morgan Stanley turned entrepreneur with experience across retail, real estate, energy, and SaaS industries, believes that “after Whole Foods, Amazon will probably replicate this exact acquisition strategy by buying a convenience store (CVS), major clothing retailer (Macy’s), then perhaps a tech appliance retailer (Best Buy). This shift will have enormous impact on job redistribution and will also create a wave of new tech and apps that will be ‘service providers’ for this new shopping experience.”

The view that Amazon’s tie-up with Whole Foods marks the beginning of a bigger push into traditional retail is shared by Fainbraun: “If this works out, Amazon will eventually buy a retailer like Nordstrom as well. It’s all about optimizing retail space with the right items and experience and having delivery options and automation for the rest.”

The widespread potential implications for the grocery and larger retail space might explain why so many retailers’ stocks took a big hit in the aftermath of the news (Chart 1). Toptal Finance Expert Neel Bhargava, whose experience in private equity and management consulting focused particularly on retail companies, points out: “Whole Foods is a major category leader that allows Amazon to enter the brick-and-mortar space in one fell swoop, and they can leverage for a lot of other things. This is why other grocers’ share prices are getting hit. It will be very hard to compete with.”

However, some are a bit more cautious in drawing conclusions too quickly. Toptal Finance Expert Ethan Bohbot, an investment banking and hedge fund analyst turned entrepreneur, says, “I think the initial drop in retailer stock prices is an overreaction and it is still to be determined if that large of a move is justified—Amazon has long tried to break into grocery and has basically admitted they need help by acquiring Whole Foods, so their success doesn’t seem like a guarantee. The market seems to already assume Amazon is going to significantly disrupt the market and take a big chunk of share, when a scenario that the impact is only incremental is not unreasonable, particularly in the near-term. At the same time, if things go well for Amazon, we could look back and say it was an underreaction, but just given the uncertainty, I think the magnitude of the move was excessive (not the direction—this is certainly a competitive threat).”

Walmart’s Acquisition of Bonobos Is More Incremental

Turning to Walmart’s acquisition of Bonobos, most agree that this acquisition is more additive than it is game-changing. Chapman says “Walmart buying Bonobos makes sense just because it’s an extension of Walmart’s clothing portfolio. This acquisition feels much more standard, cookie cutter, and kind of “boring,” honestly. The Bonobos brand will probably remain the same, hopefully not sacrificing quality (who knows), but now it will be integrated in a major way into the Walmart ecosystem.”

Fainbraun agrees: “It’s more like a hedge. Like McDonald’s buying Chipotle. Investing in a new model to learn. Amazon/Whole Foods is to completely change the model or take it to the next level—total sales channel/analytics/logistics optimization.”

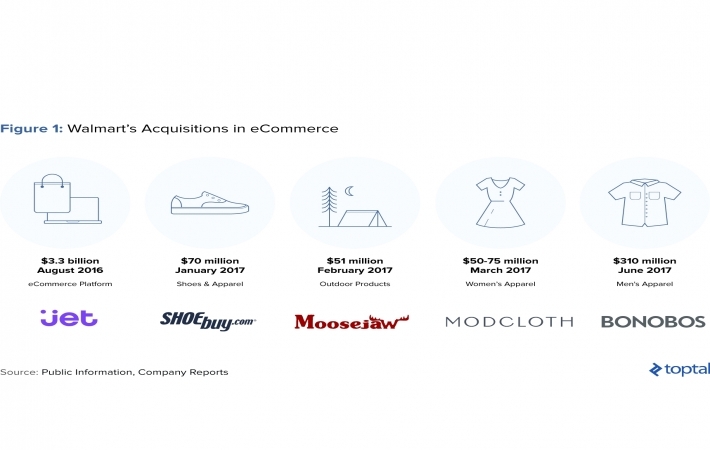

Expanding on the strategic rationales of the deal, Bohbot outlines, “This just seems like a bolt-on to their eCommerce business. I understand the strategic rationale in getting talent from a successful online-based retailer, but they have made several similar acquisitions (and at larger scale) in the past that would seemingly achieve the same goal (Jet.com, ModCloth, etc.), so I am not sure the incremental benefit is going to be as great as Amazon/Whole Foods.”

A perhaps underestimated—and certainly underreported—component of the Walmart/Bonobos deal relates to margins. On this, Toptal Finance Expert Tayfun Uslu points out that “it is important to mention that Bonobos is a vertically integrated company and, as a company that is both brand and distributor of its products, this means very high gross profit margins that cannot be easily achieved by buyers and resellers or marketplaces (i.e., Whole Foods and Amazon). Whole Foods has some private label, but it accounts for around 15% of revenue. Walmart is pushing a strategy to buy vertically integrated companies because, in the end, they do have higher gross profit margins.”

Whatever one thinks of Walmart’s strategy of diving into eCommerce via fashion, it is clear that the general trend in this space has been moving towards DTC. Established brands have been steadily increasing their share of sales from this channel as opposed to the traditional retail channels (Chart 2). Building a strong online presence in fashion in many ways necessitates a strong positioning in DTC, something which shines through in Walmart’s recent acquisitions in the space.

Compared to Amazon’s recent move, from a margin perspective, Walmart’s strategy certainly seems more accretive. Bohbot sums it up as follows: “This specific transaction for Walmart is negligible, and given the stage/scale, it may not even impact Walmart’s margins, but the overall goal is to bolster the eCommerce business, which will theoretically have higher margins and provide uplift to the overall company as the mix continues to shift towards eCommerce.”

Bohbot goes on to say: “For Amazon, the Whole Foods acquisition is a different story—brick and mortar channels have a lower margin profile than online channels given higher fixed and variable costs, so by increasing the mix of brick and mortar, Amazon is seemingly diluting their margins. Additionally, across the retail sector, grocers have a pretty poor margin profile, so increasing grocery mix of revenue will further prove to be dilutive.”

The lower margins in groceries were something that Jeff Bezos himself highlighted earlier this year. Turning to Twitter to respond to a NY Post article that claimed that Amazon Go had operating profits of more than 20% and could operate with just three human workers, the Amazon CEO had this to say:

Figure 2: Jeff Bezos on Grocery Margins

Source: Twitter

But Bohbot doesn’t seem to be concerned about this latter point. Aside from the fact—as the Wall Street Journal points out—“Whole Foods […] operates at much higher profit margins than other grocers, thanks in part to the higher markups it gets for many of its upscale items” (Chart 3), Bohbot believes “I don’t think you can simply apply Whole Foods margins to the incremental revenue Amazon is acquiring and say that will be the incremental profits - there are undoubtedly synergies (supply chain, etc.), and further, we don’t know what future Whole Foods stores are going to look like once Amazon gets in there. It is possible Amazon cuts the footprint across major stores dramatically, takes out labor, and automates a lot of the day-to-day operations such that the margins are a lot higher than Whole Foods stand-alone (reasonably somewhere in between margins achieved by online-only and brick-and-mortar-only sales channels). How much higher Amazon can drive margins is still to be seen, but I think Whole Foods stores will look very different under Amazon, and likely in a way that cuts costs and improves margins from the status quo.”

Amazon’s Acquisition Has a Strong Strategic Rationale—Walmart’s Less So.

Comparing the two moves from a strategic standpoint, Amazon’s acquisition of Whole Foods clearly comes out on top. Finance Expert Alex Graham, a former fixed income trader who has moved into venture capital, points out, “Walmart wants to buy a brand and get some soft learning from their tactics, backing them up with cash and logistics if necessary but largely treating it as a quasi aqui-hire/financial investment. Amazon probably wants to come in more directly and harness the fixed assets of Whole Foods.”

Important Real Estate Component For Amazon

The importance of the real estate component in the Amazon transaction is widely acknowledged. As Figure 3 below shows, Amazon is acquiring a strong retail footprint in many major geographical markets. Toptal Finance Expert Jeffrey Mazer, a financial expert and lawyer who has served as a transactional and valuation expert witness in the past, weighs in on this, saying, “The Amazon/Whole Foods possibilities are endless. With Whole Foods’ footprint in affluent areas and Amazon’s expertise in supply chain and delivery, they could upend both food retailing and food delivery.”

In particular, the key benefit that many have pointed to is that acquiring prime real estate allows Amazon to finally get into last-mile delivery, something the retailer has historically struggled to do. Alex Graham delves further into this: “Last mile delivery is a critical component that startups in the grocery space have been able to capitalize in Amazon’s absence. Buying an upmarket chain of supermarkets in upmarket urban areas will allow Amazon to significantly enhance its hub and spoke approach. For that reason alone, the physical assets of whole foods are a key component of this deal (and potentially a future source of contention between the two management teams if their dual use compromises the activity of the other).”

Fainbraun, however, takes a higher-level view: “I’m not so worried about grocery retailers themselves. It’s the other retailers that will be hurting more. People will still go to grocery stores for location and convenience. The ones who suffer will be the Walmarts of the world—Home Depot, big box retailers. Amazon is eating their lunch and will have class A retail location.” He continues, “Retail of the future will be about Class A experiential real estate, and Class C convenience. If Whole Foods ends up working out for Amazon, I think they will buy Nordstrom and Kmart. Nordstrom is the best department store and very efficient with space and creating stores within a store. And Kmart is cheap, good big box real estate. If I’m right, Amazon will have lifestyle center real estate, big box, and inside malls. All as drop off and pick up locations and showrooms for online ordering.”

Strong Move into Groceries

The other major benefit most Toptal Experts see is that the Whole Foods acquisition will significantly help Amazon push into a difficult niche: groceries. Groceries is an important category—a recent report by the Food Marketing Institute found that US grocery sales could grow five-fold over the course of the next decade, with spending estimated at more than $100 billion by 2025. While currently, around 25% of US households shop online for groceries (up from 20% three years ago), that number will grow to more than 70% within the next ten years.

Toptal Finance Expert Ethan Bohbot had this to say on the matter: “I think that the Amazon/Whole Foods tie-up has the potential to prove more beneficial to Amazon [than Walmart’s acquisition of Bonobos] and more disruptive to the broader grocery industry. The general shift of buying groceries online has been happening for a while if you think of platforms like Fresh Direct or Blue Apron, but it has been slow and, based on Amazon’s historical execution across other business segments and now accelerated push, I think that bodes well for them to do something game-changing—but, of course, this is still to be determined.”

Part of the reason why Amazon has had such difficulties in breaking into the online grocery shopping space comes down to trust. The FMI survey highlighted how 69% of shoppers valued the store’s reputation when choosing which store to buy groceries at (Chart 4). Bohbot sees Amazon’s acquisition of Whole Foods as beneficial in this respect, “To me, Amazon is validating the brick-and-mortar channel for grocery and acquiring a quality brand with a large footprint, which is accelerating their push into grocery by allowing them to overlay their insights and supply chain/eCommerce dominance on top of an existing strong foundation.”

Limited Customer Overlap for Walmart and Potential Backlash by Bonobos Consumers

As far as Walmart’s acquisition of Bonobos is concerned, Bohbot thinks that it was motivated by the following factors: “Acquisition of eCommerce retail talent, acquisition of proven hybrid channel (physical storefront + online fulfillment), acquisition of a quality brand, and customer acquisition of Bonobos’ client base—outside of that, I am not really sure. This would certainly expand their eCommerce presence, which theoretically would have higher margins, but given stage/scale, that may not hold true for this acquisition.”

The issue of overlapping (or lack thereof) customer bases comes up several times. Many are concerned that Walmart and Bonobos customers lack overlap, and that Walmart’s acquisition might in fact alienate them. Toptal Finance Expert Jeffrey Mazer says so himself: “I’m a customer of Bonobos, Amazon, and Whole Foods. I can’t see that I would ever purchase anything from Bonobos again. Too many stories of acquirers seeking cost savings and other synergies by cutting quality. Men’s clothing has a lot of players; it’s lower risk to just start buying from someone else.”

And he doesn’t seem to be alone. A Business Insider article recently highlighted similar sentiment by looking at the Twitter-verse post announcement (Figure 5).

Figure 5: Customer Reactions on Twitter to Bonobos/Walmart Deal

Source: Business Insider

Graham says, “Strategically, I think Amazon/Whole Foods will prevail, as it seems like there are more exciting overlaps between the customer bases of the two businesses—i.e., a Whole Foods customer probably shops on Amazon. Not sure if the same can be said about Walmart and Bonobos and that will be Walmart’s issue to contend with. And if Walmart tries too hard to force through some unnatural synergies between these two groups (like moving Bonobos’ online store into their system) they may ultimately jeopardize it all.”

Toptal Finance Expert Zachary Elfman, however, takes a different view. “An oft-cited justification for why an acquirer is willing to pay an above-market price for a target are synergies. Synergies can come in many forms, but it is not immediately clear if any meaningful revenue synergies through complementary customer bases can be achieved through the integration of Whole Foods into Amazon. There are few if any revenue synergies that Amazon is gaining with the Whole Foods acquisition because Whole Foods has a very similar customer base, if not identical. If I were to draw a Venn diagram of the companies’ customer bases, Whole Foods would sit nearly inside the (much larger) Amazon circle. Yes, this makes cross-selling existing products and services easier, but I cannot think of too many existing Whole Foods shoppers that do not already use Amazon. Flipping this around, products from Whole Foods can be sold to the expansive Amazon customer base, but I am not convinced that the Amazon distribution channel is going to really cause much greater Whole Foods penetration in an age when Instacart already allows for online ordering and home delivery.”

The Walmart-Amazon War?

Are these moves clear shots fired in a longer-term retail war between two retail giants? Bohbot takes a more measured stance on the issue: “I don’t really see it this way. Amazon isn’t attacking Walmart; they are attacking the world. Walmart is just included and is seemingly the most likely to fall victim to this specific announcement (given their grocery share), which is why people may be seeing it that way today.”

On his last point, it is important to note that Walmart’s share of grocery is very significant (Chart 5). As Retail Dive highlighted in a recent article: “Grocery is where Walmart really shines. It is the nation’s largest seller of groceries with category sales of $170 billion last year, and the category is key to driving store visits and customer loyalty. Walmart has been investing in click-and-collect programs, stand-alone grocery pick-up sites, and is even testing an automated kiosk for 24-hour pick-up.”

With the above in mind, it’s hard not to see how Amazon/Whole Foods puts Walmart on the back foot. And in fact, other Toptal Experts are more sanguine. Finance Expert Tayfun Uslu thinks that “in the race to become the first monopoly, Amazon is now ahead.” And on the monopoly point, he is not alone. In the wake of the acquisition, several articles have come out assessing the question of whether the Seattle-based retailer has perhaps gone too far. Toptal VP of Business Talent Rajeev Jeyakumar admits, “I already get most of my groceries from either Whole Foods or Amazon Fresh. So they’ve got a lock on my wallet share! Especially if you throw in Alexa ordering and if they acquired Grubhub—I may never leave the couch. I might as well get my Amazon credit card now and let them take that part of the value chain too.”

So perhaps the picture is a far more aggressive one, with Amazon’s move an all-out declaration of war. Finance Expert Sebastian Fainbraun certainly seems to think so: “They aren’t declaring war—they are declaring victory. Walmart has a good web presence but Amazon runs the internet. If they integrate properly, war over. Amazon is the new Walmart and Bezos is the new Walton.”